The investment landscape is a dynamic and unpredictable market. For beginners, it can appear difficult and impossible to navigate. While many venture into the market, a staggering number show that many make investment decisions without knowing how it all works. This is where Vysoký Hodnotař comes in handy.

Vysoký Hodnotař is an innovative solution designed for beginners and investors looking to become financially literate. With many options and strategies flooding the financial market, it may be wise to build a solid educational foundation. With Vysoký Hodnotař, beginners and investors can easily connect to investment education firms.

The top of this offer is that Vysoký Hodnotař makes this service free and accessible to anyone willing to learn. Delving into the financial market is like any professional venture; a level of knowledge is required to participate. Sign up with Vysoký Hodnotař to get informed about the financial market.

Hey! Don’t know the first thing about investing? Worry less; even Warren Buffet started from somewhere. With Vysoký Hodnotař, no prior knowledge is required to learn how to invest.

Starting as a new investor can be challenging. Why not let Vysoký Hodnotař help? Certain terminologies like stocks, shares, and risk management can be easily understood.

With a minimum deposit of zilch, anyone willing to learn can register on Vysoký Hodnotař and connect with suitable investment education firms. Sign up with Vysoký Hodnotař for free.

When people sign up with Vysoký Hodnotař, they are matched with suitable investment education firms. These firms then assign a representative of the firm to secure the user’s onboarding.

To ensure beginners are appropriately set up, the representative allows them to pick a learning preference. Sign up with Vysoký Hodnotař for free to get started.

Financial literacy refers to the necessary knowledge and skills every investor must have. It includes a basic understanding of investing principles, strategy, and skills. Sign up with Vysoký Hodnotař to learn more.

Financial Literacy to an investor is power. With it, an investor can tackle the financial market, carry out essential research, and make strategic investment decisions. Sign up with Vysoký Hodnotař to learn more.

The core of Vysoký Hodnotař is spreading financial literacy. The financial market is too volatile a maze for anyone to wonder ignorantly. Thanks to Vysoký Hodnotař, anyone can access financial literacy and make objective investing decisions.

The financial market is an intricate space to explore. With emerging ideas and initiatives, finding ground as an investor can feel impossible. Especially now with the internet. To make sense of it all, one should start by investing quality time into a financial education scheme.

However, finding a suitable investment education scheme can be even more challenging. This is why Vysoký Hodnotař was created. Vysoký Hodnotař has done the hard work of curating a list of investment education firms. All beginners need to do is sign up and connect with investment education firms that are suitable for them for free!

Investing is more a mindset than many realize. Braving the financial market requires an evaluation of goals, objectives, and available resources. It is important to bear in mind that investing isn’t a get-rich scheme. An investor should have a clear idea of their goals and utilize available resources to pursue them. Sign up with Vysoký Hodnotař to learn more.

Seasoned investors like Warren Buffet have one thing in common – Dedication. Becoming an investor in today’s dynamic financial market requires strong intention and dedication. When dedicated and passionate, investors may remain unfazed in any potential investment crisis. Sign up with Vysoký Hodnotař to learn more.

The financial market has many inherent risks. These risks are non-negotiable and known for their potential to cause a major decline in the value of an investor’s asset or expected returns. Vysoký Hodnotař offers beginners a strategic approach to risk management: The Education-First Approach, encouraging them to get educated before making any investment decisions.

It Is Difficult To Invest As A Newbie

Vysoký Hodnotař cannot deny how difficult the financial market appears to a newbie.

Financial Education Makes Investing Easy To Understand

Getting educated on basic investing principles provides appropriate insights into investing.

Financial Education Doesn’t Have To Cost An Arm and A Leg

For anyone looking for a knowledge bank, try out Vysoký Hodnotař for free and connect with suitable tutors.

Navigating the financial market is a long-term career. While the investor might be tempted by greed, impulse, or emotion, it is necessary to establish dedication and discipline as a principal attitude to investing. Sign up with Vysoký Hodnotař to get started learning about these things.

Vysoký Hodnotař is on a global mission, encouraging anyone curious about becoming an investor. When beginners are trained on the foundations of the financial market and are taught to carry out research and strategic analysis, they can learn their way to making informed decisions. Sign up with Vysoký Hodnotař and connect with suitable tutors.

The financial market is believed to have existed in ancient ages. The earliest record dates back to ancient Mesopotamia, Egypt, and Italy. During this period, commodities such as natural resources, livestock, and agricultural produce were bought and sold through the trade-barter system.

The launch of the Amsterdam Stock Exchange by the Dutch East India Company in the 17th century. The Netherlands laid the foundations for modern financial markets. This led to the rise of financial markets all over London and New York in the 18th and 19th centuries. These suffered a major decline during the Great Depression of 1930 and again in 2008.

The rise of technology and fintech innovations have revolutionized the financial market of the 21st century. The advent of digital and cryptocurrencies has transformed the financial landscape, facilitating the participation of government, institutions, and corporate and private investors in raising capital for economic development. Sign up with Vysoký Hodnotař to learn more.

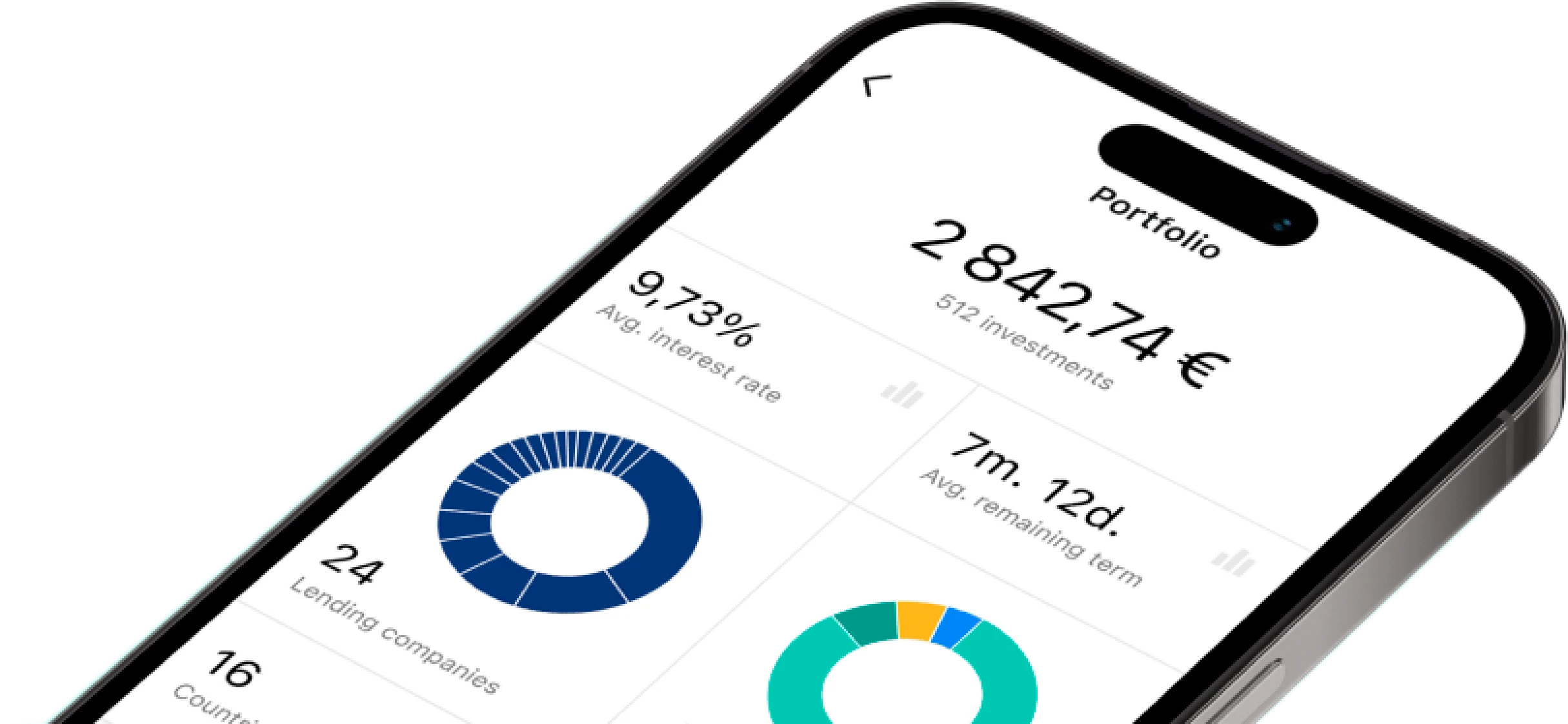

The financial market is a landscape made up of many assets. Common assets include the stock market, bonds, commodities, and real estate. These assets are known as financial securities and are the instruments investors use to trade in the financial market.

Each of these markets has a level of risk proportional to their inherent value. Investors need to build a diversified portfolio, but the ability to choose any of them requires financial literacy and objective evaluation. Sign up with Vysoký Hodnotař to connect with suitable tutors and learn how to choose investment options.

The stock market is an avenue to share in the ownership of a public company or establishment. It is the most common and most volatile financial market. The returns on investment depend on the performance of the market. Sign up with Vysoký Hodnotař to learn more about the stock market.

Bonds, unlike stocks, are fixed security and are loans issued by government, corporations, and private investors. The possible returns on investment are fixed to increase at an interest rate against a future date. Sign up with Vysoký Hodnotař to learn more about the bonds market.

The cryptocurrency market is a new and innovative market where investors trade digital or virtual currencies as financial securities. It started with the launch of Bitcoin in 2009, but today, cryptocurrencies like Ethereum (ETH) and Litecoin (LTC) are popularly traded. Sign up with Vysoký Hodnotař to learn more about the cryptocurrency market.

The commodities market is unique in the financial landscape. Here, investors trade off physical resources like gold, crude oil, livestock, and agricultural produce. These may be used to counter inflation and other possible economic crises. Sign up with Vysoký Hodnotař to learn more about the commodities market.

An investor is anyone who participates in the activity of the financial market. They commit capital and funds to financial security to try for positive returns.

However, to maximize financial assets or securities, seasoned investors ensure they are informed on the value of the market, access relevant information, perform strategic analysis, and predict the relevance of the asset to their investment objectives. Sign up with Vysoký Hodnotař to learn more.

In the financial market, prominent topics of discussion are risk management and principles of strategic investing. To manage the effect of something as inevitable as risk requires knowledge and a skill set, which are developed over time.

Strategic principles, on the other hand, are categorized into two: Fundamental and Technical analysis. Fundamental analysis is carried out by examining the periodic financial performance of a company or an asset and using that as an indicator of risk investing.

Technical Analysis is a more quantitative analysis. Here, an investor carries out historical research on the financial performance of an asset, considers chat patterns, and uses this to predict the future of that asset before investing. Sign up with Vysoký Hodnotař to learn more.

There is nothing like a jack of all trades when it comes to investing. The financial market has a varied form of investors, each with a level of risk tolerance, principal strategies, and objectives. Every investor falls into one of these. For beginners looking to niche down their investment venture, Vysoký Hodnotař is here to help. Sign up with us to learn more.

Angel investors are wealthy individuals who provide capital in the earlier stages of a project or startup.

Retail investors are investors with smaller portfolios and trade financial securities for possible gains.

These are just like angel investors, who invest in the later stages of a project or startup. They are more professional and pool capital from multiple sources.

Income investors are investors that specialize in the bonds market and other fixed securities. They do this to seek a steady return from their investments.

Active investors are investors who actively trade securities in the financial market over a short period. Their risk tolerances are usually higher.

Passive investors, unlike active investors, engage with indexes in the financial market over a long period. Their risk tolerance is not as high as that of active investors.

With Vysoký Hodnotař, learning to invest can be exciting and easy. For anyone ready to grasp the nuances of investing and find out the investment plan suitable for them, Vysoký Hodnotař can connect them directly with suitable investment education firms. The journey to becoming an informed investor is only a link away. Sign up with Vysoký Hodnotař to get started.

| 🤖 Registration Fee | Zero cost to register |

| 💰 Administrative Fees | Fee-free service |

| 📋 Enrollment Ease | Simple, quick setup |

| 📊 Study Focus | Insights into Digital Currencies, Forex, and Investment Funds |

| 🌎 Country Availability | Available in nearly every country except the US |